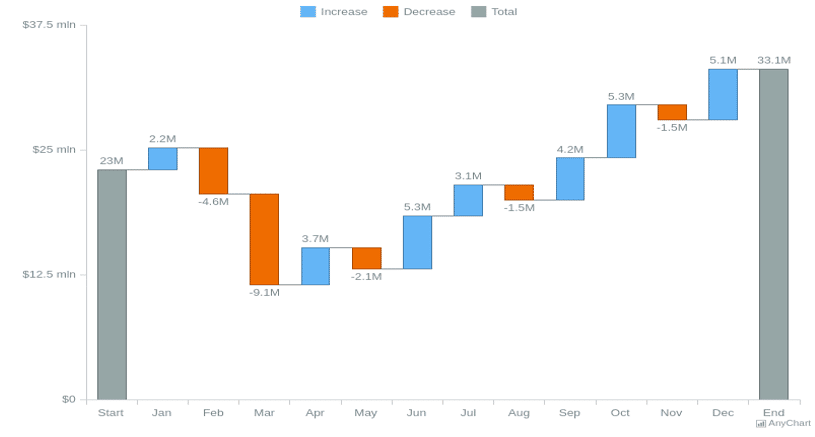

Waterfall charts are a great way to visualize how different parts of a whole contribute to the total. They can be used to show how…

View More When To Use Waterfall ChartsCategory: Investment

All About Public Provident Fund (PPF): Features & Benefits

What is a Public Provident Fund? A Public Provident Fund (PPF) is a popular savings scheme in India that came to act in 1968. With…

View More All About Public Provident Fund (PPF): Features & BenefitsPradhan Mantri Garib Kalyan Yojana (PMGKY): All you need to know

The preamble of the Indian constitution states that the country is a democratic republic that works for the welfare of its people. In view of…

View More Pradhan Mantri Garib Kalyan Yojana (PMGKY): All you need to knowWhat is Pradhan Mantri Jan Dhan Yojana & How to Open PMJDY Account?

India is a country that requires economical and financial schemes for the development of its citizens. One such scheme that was introduced by the ministry…

View More What is Pradhan Mantri Jan Dhan Yojana & How to Open PMJDY Account?National Pension Scheme (NPS) – Features, Advantages & Tax Benefits

National pension scheme or NPS as popularly known is a central government initiated program. This scheme enables employees to plan their finances better. Employees can…

View More National Pension Scheme (NPS) – Features, Advantages & Tax BenefitsNational Savings Certificate (NSC): Benefits, Interest Rates, and Tax Savings

What is the National Savings Certificate (NSC)? National Savings Certificate is an Indian Government Scheme that provides fixed income to investors and thus, acts as…

View More National Savings Certificate (NSC): Benefits, Interest Rates, and Tax SavingsSukanya Samriddhi Yojana (SSY): Account Eligibility, Interest Rate, Benefits

In relation to the campaign launched by the India government, a number of schemes were started. Sukanya Samriddhi Yojana was introduced by the government in…

View More Sukanya Samriddhi Yojana (SSY): Account Eligibility, Interest Rate, BenefitsFloating Rate Savings Bonds 2020 (Taxable): All you Need to Know

What are Floating Rate Savings Bonds 2020? The Government of India launched a new investment scheme named Floating Rate Savings Bonds 2020 after the suspension…

View More Floating Rate Savings Bonds 2020 (Taxable): All you Need to KnowWhy Investing is Important & Where to Invest in India?

Why Investments? Investments are a crucial part of our life because the money that we earn is not enough to lead a life in today’s…

View More Why Investing is Important & Where to Invest in India?6 Easy Ways To Start Investing With Little Money

People who are new to the investment can start investing little money to avoid higher risks. If you have $2000, you can invest $25, which…

View More 6 Easy Ways To Start Investing With Little Money